Applying for an Australian Business Number (ABN) is a fundamental step for any individual or entity looking to conduct business in Australia. Whether you’re a sole trader, a partnership, a company, or a trust, having an ABN not only facilitates your business dealings but also enhances your credibility in the marketplace. In this detailed guide, we’ll walk you through the process of obtaining an ABN step by step, ensuring you have all the information you need to make the application process as smooth and straightforward as possible.

Introduction To The ABN System

The ABN is an 11-digit number that serves as a unique identifier for your business to the government and community. It’s used in various transactions, from invoicing and ordering to tax and other business-related activities. Obtaining an ABN is free and can offer your business a range of benefits, including the ability to register for Goods and Services Tax (GST), claim GST credits, and more.

Assessing Your Eligibility

Before you dive into the application process, it’s crucial to determine whether you’re eligible for an ABN. The eligibility criteria are quite broad: you need to be carrying on or starting an enterprise in Australia, or be making supplies connected with the Australian indirect tax zone, or be a Corporations Act company. This encompasses a wide range of business structures and activities, from sole traders and freelancers to larger companies and non-profit organizations.

Preparing Your Documentation

A smooth ABN application process starts with preparation. You’ll need to gather some essential information before you begin. This includes:

- Your Tax File Number (TFN) and the TFNs of any other associates involved in your business.

- Details about your business structure, such as whether you’re a sole trader, partnership, company, or trust.

- Personal identification details, including your name, date of birth, and contact information.

- Information about your business activities, including the nature of your business, the location of your business activities, and your business’s expected turnover.

Also Read: Unlocking Business Opportunities With Your ABN

The Application Process: A Step-By-Step Guide

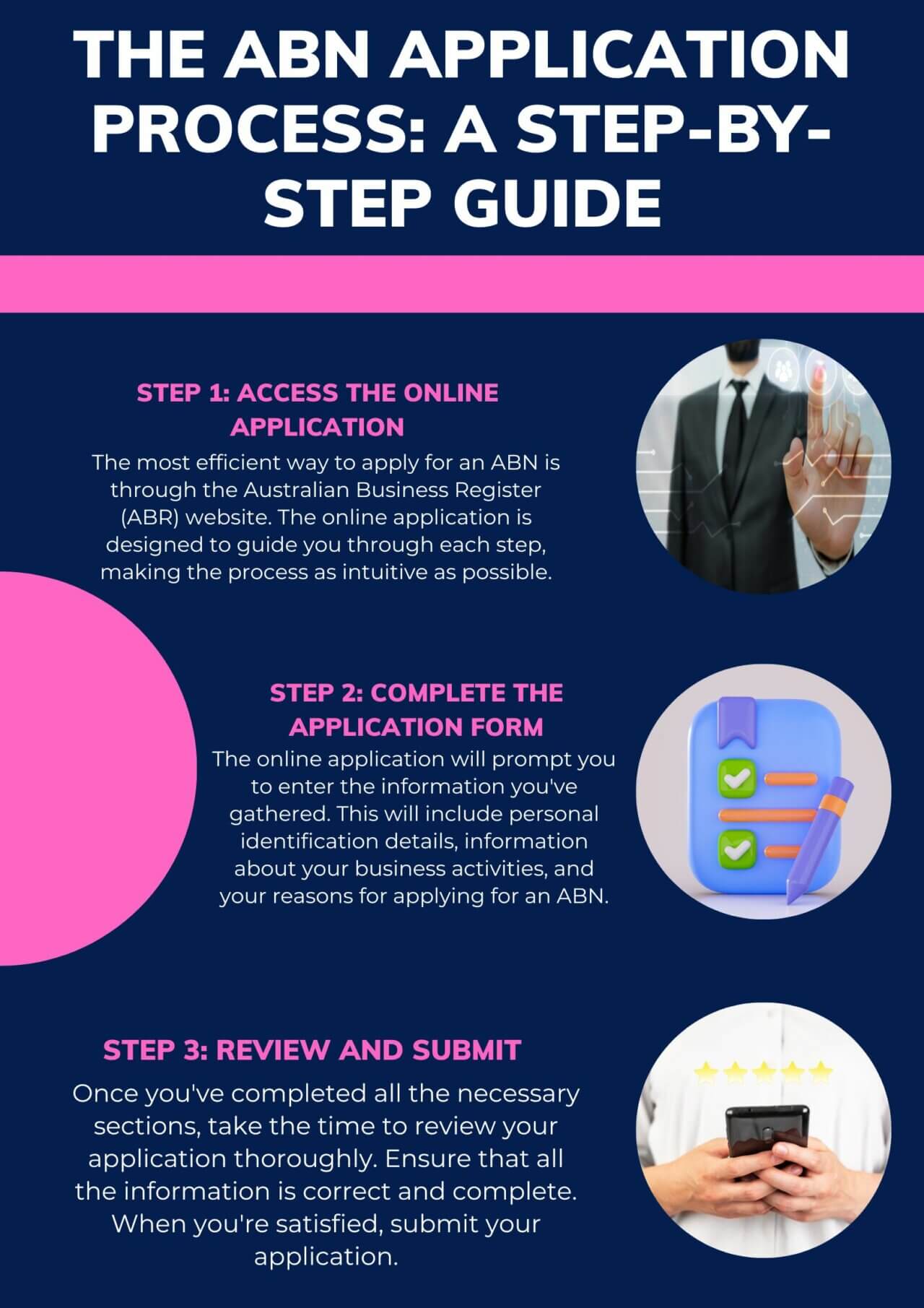

Step 1: Access The Online Application

The most efficient way to apply for an ABN is through the Australian Business Register (ABR) website. The online application is designed to guide you through each step, making the process as intuitive as possible.

Step 2: Complete The Application Form

The online application will prompt you to enter the information you’ve gathered. This will include personal identification details, information about your business activities, and your reasons for applying for an ABN. It’s crucial to be as accurate and truthful as possible in this step to avoid any delays or issues with your application.

Step 3: Review And Submit

Once you’ve completed all the necessary sections, take the time to review your application thoroughly. Ensure that all the information is correct and complete. When you’re satisfied, submit your application. In many cases, you’ll receive your ABN instantly upon submission if all your details can be verified online.

After You’ve Applied

Receiving Your ABN

If your application is successful and can be verified online, you should receive your ABN immediately. However, some applications may require manual review, which can take up to 28 days. During this time, it’s important to monitor your application status and be prepared to provide additional information if requested.

Utilising Your ABN

With your ABN in hand, you can now undertake a variety of business activities with greater ease. This includes registering for GST if your business has a turnover of $75,000 or more, invoicing clients, and establishing a business identity in the marketplace.

Also Read: Innovative Marketing Strategies For Small Businesses In 2024

Keeping Your ABN Details Current

It’s important to keep your ABN details up to date. If any of your business details change, such as your address, business structure, or contact information, you should update your ABN information as soon as possible. This ensures that your business remains compliant and avoids any potential issues with the Australian Taxation Office (ATO) or other government bodies.

Navigating Common Hurdles In The ABN Application Process

Despite the straightforward nature of the ABN application process, applicants can sometimes encounter hurdles. Understanding these potential challenges can help you navigate them more effectively.

Incomplete Or Incorrect Information

One of the most common reasons for application delays or rejections is the submission of incomplete or incorrect information. To avoid this, double-check all entries for accuracy, especially your Tax File Number (TFN) and personal identification details. If you’re unsure about any section, it’s better to seek clarification than to guess.

Business Activity Descriptions

The ABR requires specific descriptions of your business activities to determine eligibility. Vague or overly broad descriptions can lead to delays. Be precise and detailed about your business’s nature, the primary income sources, and the services or products you offer.

Legal Structure Confusion

Choosing the correct legal structure for your business is crucial, as this affects your tax obligations and legal responsibilities. Whether you’re a sole trader, partnership, company, or trust, ensure that the structure you select reflects your business arrangement accurately. If you’re uncertain, consider consulting a business advisor or accountant.

Also Read: Effective Debt Management For Australian Sole Traders

Maximising The Benefits Of Your ABN

Having an ABN opens up a myriad of opportunities and benefits for your business. Maximizing these benefits can lead to improved business efficiency and growth.

GST Registration

If your business has a turnover of $75,000 or more, you’re required to register for GST. Doing so allows you to claim back the GST you’ve paid on business expenses, potentially improving your cash flow. Even if you’re below the threshold, voluntary GST registration might benefit your business, especially if you deal with other GST-registered businesses.

Business Identity And Credibility

Your ABN serves as a public record of your business, enhancing its credibility and professionalism. Displaying your ABN on invoices and other business documents reassures clients and suppliers of your legitimacy, fostering trust and confidence in your business dealings.

Access To Government Services And Initiatives

An ABN allows you to access various government services, grants, and initiatives designed to support businesses. This can include funding programs, advisory services, and training opportunities that can help grow and develop your business.

Future-Proofing Your Business With ABN Compliance

Maintaining compliance with ABN regulations is essential for the long-term success and legality of your business. Staying informed and proactive in your compliance efforts can save you from potential legal and financial pitfalls.

Regularly Update Your ABN Details

As your business evolves, so too might your contact details, business structure, or activities. Regularly updating your ABN details ensures that your business remains compliant and that government records are accurate and current.

Understand Your Tax Obligations

Your ABN is tied to your business’s tax obligations, including income tax, GST, and other applicable taxes. Staying on top of these obligations, including timely lodgments and payments, is crucial to avoid penalties and interest charges.

Also Read: Top 10 Spreadsheet Tools: Excel To SoleApp 2024

Stay Informed About Changes In Legislation

Tax laws and business regulations in Australia can change, impacting your responsibilities as an ABN holder. Staying informed about these changes, either through the ATO website or by consulting with a tax professional, can help you adapt and ensure ongoing compliance.

Conclusion

Obtaining an ABN is a key step in establishing and running a business in Australia. By following the steps outlined in this guide, you can navigate the application process with confidence, ensuring that your business is set up for success from the start. Remember, the key to a smooth application process is preparation and accuracy, so take the time to gather all necessary information and double-check your application before submission. With your ABN, you’re well on your way to a thriving business venture in Australia.