In the vast tapestry of financial management, expense tracking stands out as a vital thread. At its core, it’s about understanding where money goes, making adjustments, and optimising for the future. The journey of expense tracking over the years provides a fascinating glimpse into both advancements in technology and changing societal norms related to money management.

Before the digital age, expense tracking was an entirely manual process. People would jot down details in ledgers, stash away receipts in drawers or shoeboxes, and then manually tally everything at month’s end, quarter’s end, or even year’s end. This process was laborious, time-consuming, and rife with potential errors.

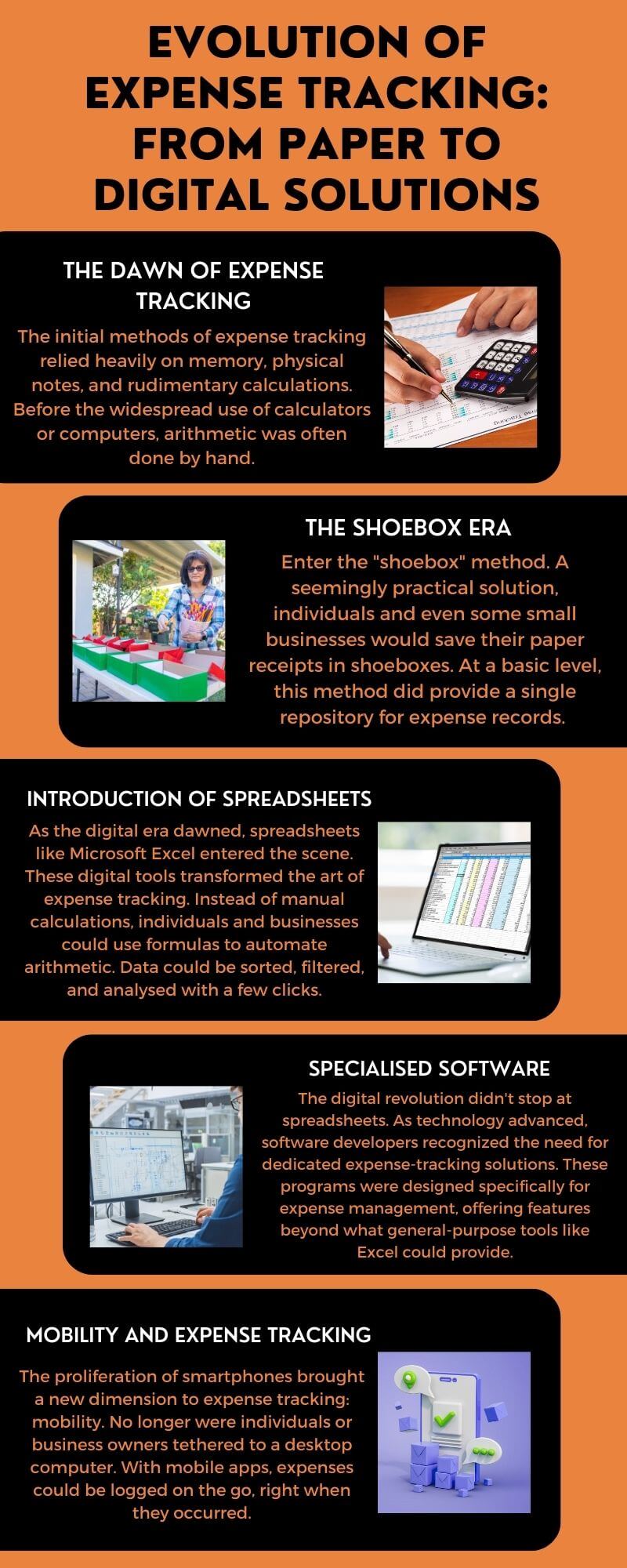

The Dawn Of Expense Tracking: Manual Entry

The initial methods of expense tracking relied heavily on memory, physical notes, and rudimentary calculations. Before the widespread use of calculators or computers, arithmetic was often done by hand. This led to a system vulnerable to human error.

Moreover, this manual method posed challenges in terms of storage and organization. As the months and years went by, the physical documentation of expenses would pile up, often becoming an overwhelming mass of paper that was difficult to sift through. It wasn’t uncommon for crucial receipts or notes to go missing, leading to inaccurate financial records.

Also Read: How To Sell Personal Training: Expert Tips For Success

Another issue with this approach was the lack of easy data retrieval. If someone needed to review expenses from a specific time period or category, they’d need to invest a significant amount of time digging through their records.

The Shoebox Era: Receipts And Paper Galore

Enter the “shoebox” method. A seemingly practical solution, individuals and even some small businesses would save their paper receipts in shoeboxes. At a basic level, this method did provide a single repository for expense records. However, the shoebox was often a chaotic mess of crumpled papers, faded ink, and lost information.

While this method did centralize the receipts, it didn’t categorize or organize them. When tax season arrived, or when a financial review was needed, sorting through the jumbled mess was a daunting task. Often, this led to missed deductions or unaccounted expenses. Additionally, paper receipts fade over time, further complicating the tracking process.

Introduction Of Spreadsheets: A Digital Shift

As the digital era dawned, spreadsheets like Microsoft Excel entered the scene. These digital tools transformed the art of expense tracking. Instead of manual calculations, individuals and businesses could use formulas to automate arithmetic. Data could be sorted, filtered, and analysed with a few clicks.

Also Read: How To Find A Personal Trainer For Seniors Today

The move to digital tracking reduced errors and made it easier to create monthly or yearly financial reports. However, while spreadsheets were revolutionary, they still required manual data entry. This meant that individuals or employees had to sit down and input each expense line-by-line, which was time-consuming.

Despite their limitations, spreadsheets marked a significant advancement in the realm of expense tracking, laying the groundwork for more sophisticated solutions that would soon emerge.

Specialised Software: Dedicated Expense Tracking Solutions

The digital revolution didn’t stop at spreadsheets. As technology advanced, software developers recognized the need for dedicated expense-tracking solutions. These programs were designed specifically for expense management, offering features beyond what general-purpose tools like Excel could provide.

Such software solutions could categorise expenses, generate detailed reports, and even integrate with bank accounts or credit cards for more automated data retrieval. For businesses, this was a game-changer. It led to enhanced accuracy, reduced time spent on manual entry, and better insights into financial health.

Mobility And Expense Tracking: The Advent Of Smartphone Apps

The proliferation of smartphones brought a new dimension to expense tracking: mobility. No longer were individuals or business owners tethered to a desktop computer. With mobile apps, expenses could be logged on the go, right when they occurred.

From snapping photos of receipts to categorizing expenses with a tap, mobile apps streamlined the process. Additionally, with cloud integration, data could be synced across devices in real time. This meant that a receipt snapped on a phone could instantly be viewed and managed on a desktop.

Cloud Storage: Revolutionizing Data Accessibility And Security

With the introduction of cloud storage, the game was changed once again. Instead of storing data on a physical device, it could now be saved on the cloud, ensuring accessibility from anywhere on any device. This not only provided convenience but also added an extra layer of security. If a device was lost or compromised, the data remained safe and intact in the cloud.

Cloud storage providers implemented robust encryption and security measures, ensuring data privacy and protection. Furthermore, the real-time syncing capabilities meant that everyone involved—from business owners to accountants—could have up-to-date financial data at their fingertips.

Also Read: How To Become A Personal Trainer In Australia? A Detailed Guide

Automation And Artificial Intelligence: The Future Of Expense Tracking

With the rise of artificial intelligence (AI) and machine learning, predictive analytics began playing a role in forecasting expenses and identifying spending trends. Automated data entry, powered by AI, reduced the need for manual input, further refining the process.

The potential of AI in expense tracking is vast. From smart categorization of expenses to alerting users about potential savings or discrepancies, the possibilities are continually expanding, driving efficiency to unprecedented levels.

Challenges And Concerns In Modern Expense Tracking

However, the evolution hasn’t been without its challenges. As with all digital transformations, concerns about data privacy and security have arisen. While cloud storage and AI offer numerous benefits, they also introduce potential vulnerabilities. Ensuring robust encryption, regular software updates, and educating users about safe practices are paramount.

Another challenge is striking a balance between automation and human oversight. While AI can predict and categorize, there’s still a need for human judgment to ensure accuracy and context in expense tracking.

Sole App: Leading The Way In Modern Expense Management

The Sole app stands out Among the myriad modern tools available for expense tracking. Designed with user-friendliness in mind, Sole offers a holistic approach to financial management. From capturing receipts with a simple photo to offering deep business insights, Sole caters to the needs of both individuals and businesses.

One of Sole’s standout features is its cloud storage capability. Receipts and expenses are securely stored on the cloud, ensuring easy access from any device. This not only simplifies the tracking process but also ensures data security and longevity.

Furthermore, with its competitive pricing, Sole presents a cost-effective solution in the expense management market. Its integration capabilities, user interface, and focus on providing actionable insights make it a leader in the industry.

Conclusion

The evolution of expense tracking mirrors the broader digital transformation journey. From the rudimentary shoebox method to the sophisticated cloud-based tools of today, the journey has been about optimization, efficiency, and adaptability. As we look to the future, tools like the Sole app exemplify the potential of technology to further refine and simplify the art of expense management.