In an era where efficiency and precision are paramount, accounting software stands out as a beacon of innovation, transforming the mundane task of managing finances into a streamlined and insightful process. Particularly within the Australian context, where small businesses and freelancers form the backbone of the economy, the adoption of such digital tools is not just an option but a necessity for staying competitive.

This article delves into the intricate relationship between accounting software and productivity, unravelling how these digital solutions reshape business operations, empower decision-makers, and, ultimately, catalyse growth.

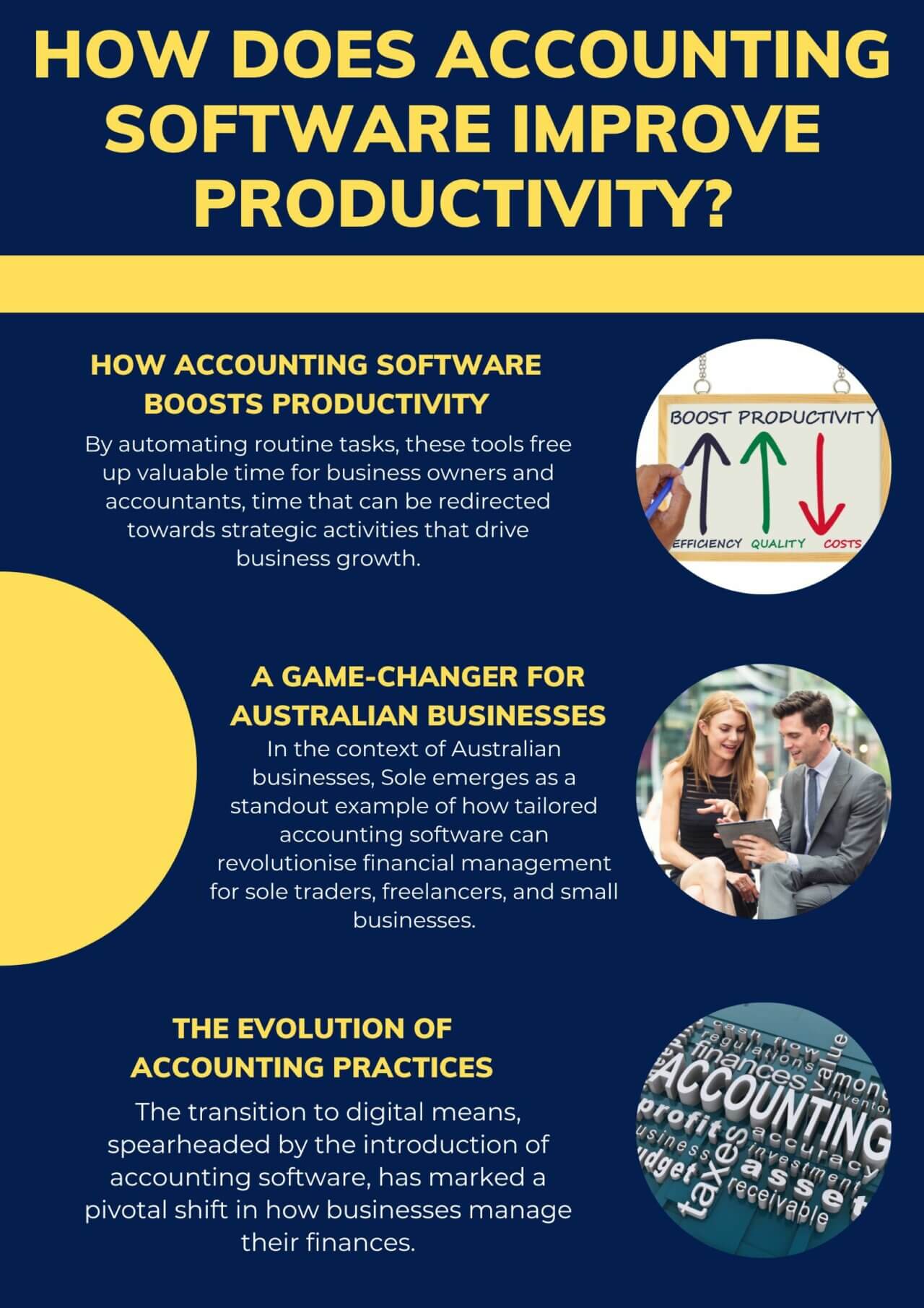

The Evolution Of Accounting Practices

Tracing back to the era of ledger books and manual calculations, the journey of accounting practices has been nothing short of revolutionary. The transition to digital means, spearheaded by the introduction of accounting software, has marked a pivotal shift in how businesses manage their finances.

This evolution reflects a broader trend towards technology-driven solutions aimed at enhancing accuracy and efficiency in financial reporting. In the Australian market, where agility and adaptability are crucial, the impact of this technological leap has been profound, offering businesses an opportunity to streamline their operations and focus on strategic growth.

Key Features Of Modern Accounting Software

In the heart of modern accounting software lies a suite of features designed to meet the multifaceted needs of today’s businesses. Automation stands as a cornerstone, eliminating the tedious manual entry of data and thereby reducing the margin for error. This automation extends across various functionalities, from invoicing to bank reconciliations, ensuring that financial transactions are recorded accurately and efficiently.

Also Read: Work-Life Balance For Sole Traders: Top Tips

Beyond mere data entry, these digital tools offer real-time financial reporting and analytics, a critical asset for business owners and managers. The ability to access up-to-the-minute financial data provides an unparalleled insight into the company’s financial health, enabling informed decision-making. Furthermore, scalability and flexibility are integral, allowing the software to adapt as a business grows and changes, ensuring that the financial management needs of sole traders, freelancers, and small to medium-sized enterprises (SMEs) are consistently met.

How Accounting Software Boosts Productivity

The introduction of accounting software into a business’s financial management practices heralds a significant leap in productivity. By automating routine tasks, these tools free up valuable time for business owners and accountants, time that can be redirected towards strategic activities that drive business growth. The reduction in human error through automated systems not only ensures accuracy but also saves the additional hours that would otherwise be spent rectifying mistakes.

Furthermore, the enhanced decision-making facilitated by accurate financial insights can significantly impact a business’s direction and success. With real-time data at their fingertips, business owners can make swift adjustments to their operations, seize opportunities as they arise, and mitigate risks more effectively.

Streamlined tax preparation and compliance are other critical areas in which productivity gains are realised. The software’s ability to manage and categorise expenses, calculate tax obligations, and generate reports simplifies the once daunting task of tax filing, ensuring compliance and peace of mind.

The economic impact of adopting such software must be balanced. The cost-effectiveness and potential for return on investment from using accounting software are compelling for Australian businesses, where tight margins and competitive landscapes prevail.

Businesses can realise significant cost savings by minimising financial inaccuracies and enhancing operational efficiency. Moreover, the scalability of these digital solutions means that as a business grows, its accounting system can grow with it, avoiding the need for costly system changes or upgrades.

Case Study: Sole – A Game-Changer For Australian Businesses

In the context of Australian businesses, Sole emerges as a standout example of how tailored accounting software can revolutionise financial management for sole traders, freelancers, and small businesses. Designed with the unique needs of the Australian market in mind, Sole offers a suite of features that directly address the challenges faced by small business owners and freelancers.

Sole simplifies the accounting process, allowing users to ditch cumbersome spreadsheets and manual record-keeping in favour of a streamlined, intuitive platform. From sending professional quotes and invoices in seconds to connecting multiple bank accounts for easy tracking of income and expenses, Sole makes it effortless to stay on top of financial management. Perhaps most importantly, Sole is designed to evolve based on user feedback, ensuring that it continuously adapts to meet the changing needs of its user base.

Also Read: The Impact Of Artificial Intelligence On Small Business Efficiency

The introduction of Sole’s ‘free forever’ access marks a significant milestone in the company’s commitment to supporting Australian small businesses. This initiative ensures that all users, regardless of their financial situation, have access to essential accounting tools to manage their business, finances, and accounting needs effectively. By offering a comprehensive financial toolkit at no cost, Sole is not just a software provider but a partner to Australian businesses in their journey towards growth and success.

Conclusion: Embracing The Future With Sole’s Free Forever Access

The intersection of accounting software and productivity represents a significant evolution in how businesses manage their finances. The advent of digital solutions like Sole has not only simplified the accounting process but also empowered businesses with the tools they need to make informed decisions, streamline operations, and achieve sustainable growth.

With features tailored to the Australian market, Sole stands out as a beacon for sole traders, freelancers, and small businesses seeking to enhance their financial management practices.

Sole’s new ‘free forever’ access is a testament to the company’s commitment to the Australian small business community. This initiative offers a lifeline to businesses navigating the challenges of financial management, providing them with a powerful toolset at no cost.

In doing so, Sole is not just improving productivity; it’s shaping the future of business in Australia, ensuring that every business, no matter its size, has the opportunity to thrive. As we look towards a future where digital solutions continue to drive business efficiency and innovation, the role of accounting software in shaping this landscape cannot be underestimated.