Navigating the complexities of international tax laws is an increasingly pertinent issue for Australian sole traders. In today’s global economy, expanding beyond the shores of Australia not only opens doors to new markets and opportunities but also introduces a myriad of tax considerations. This comprehensive guide aims to shed light on the intricacies of international tax laws and how Australian sole traders can effectively manage them.

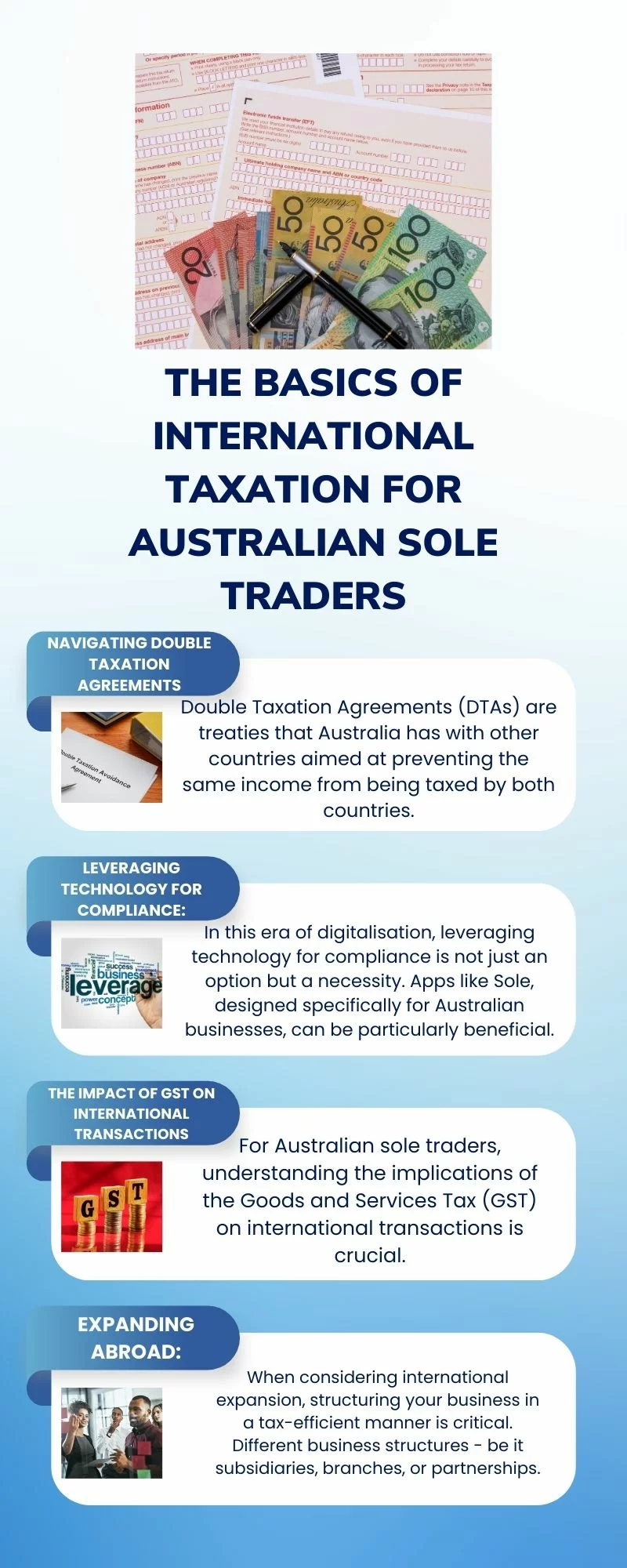

The Basics Of International Taxation For Australian Sole Traders

The journey into international business starts with understanding the basics of international tax laws. These laws are pivotal in determining how income earned overseas is taxed. It’s not just about the rates but the intricate rules that govern taxable income in different jurisdictions.

Australia has tax treaties with numerous countries, and these can significantly influence the amount of tax you’re liable to pay. For instance, some treaties provide relief from double taxation, ensuring the same income isn’t taxed twice.

Also Read: Soleapp Review: Best Tax Accounting Software

Navigating Double Taxation Agreements

Double Taxation Agreements (DTAs) are treaties that Australia has with other countries aimed at preventing the same income from being taxed by both countries. It’s vital for sole traders to understand these agreements as they can significantly reduce tax liabilities. DTAs define which country has the right to tax certain income, which can affect where and how much tax you pay.

Leveraging Technology For Compliance: The Role Of Sole App

In this era of digitalisation, leveraging technology for compliance is not just an option but a necessity. Apps like Sole, designed specifically for Australian businesses, can be particularly beneficial. Sole offers features that simplify managing finances and staying compliant with tax laws, both local and international. It provides a user-friendly interface for tracking income, and expenses and even helps prepare for tax time, making it an indispensable tool for sole traders navigating the complex terrain of international taxation.

Understanding Tax Residency And Its Implications

Tax residency is a pivotal concept in international taxation. Your status as a tax resident in Australia or any other country can significantly impact your tax obligations. Australian sole traders need to understand the criteria for tax residency as defined by the Australian Taxation Office (ATO) and how it affects their international income. This includes understanding the implications of being a resident for tax purposes and how it affects your global income.

The Impact Of GST On International Transactions

For Australian sole traders, understanding the implications of the Goods and Services Tax (GST) on international transactions is crucial. The GST has specific rules that apply to exported and imported goods and services, and getting a grasp on these is essential for accurate tax reporting and compliance. For instance, exports are generally GST-free, but there are conditions that need to be met to qualify for this concession.

Expanding Abroad: Structuring Your Business For Tax Efficiency

When considering international expansion, structuring your business in a tax-efficient manner is critical. Different business structures – be it subsidiaries, branches, or partnerships – have varying tax implications in different countries. This section of the article will delve into how each structure impacts your tax obligations and what you need to consider when choosing the right structure for your international business endeavours.

Also Read: Sole Trader Vs Company: Key Differences Explained

Record Keeping And Reporting For International Transactions

Effective and accurate record-keeping is the backbone of managing international tax obligations. Maintaining detailed records of all international transactions is not just a best practice; it’s a requirement for compliance.

This means keeping track of invoices, receipts, bank statements, and any other documentation related to overseas income and expenses. Digital tools, such as the Sole app, can significantly streamline this process. Providing an easy way to capture and store financial transactions, these tools help ensure that all necessary documentation is readily available for tax purposes.

Navigating Tax Laws In Specific Countries

For Australian sole traders looking to venture into specific countries, it’s vital to have a clear understanding of the local tax laws. Each country has its own set of rules and regulations when it comes to taxation. For instance, some countries might have higher tax rates but offer more deductions and credits.

Others may have reciprocal tax agreements with Australia, which could affect your overall tax liability. Providing an overview of tax laws in key markets like the United States, the United Kingdom, China, and India, this section would help traders get a preliminary idea of what to expect and prepare for.

Seeking Professional Advice: When And Why

While technology solutions like the Sole app can simplify many aspects of financial management and tax compliance, there are scenarios where professional advice is indispensable. Complex international tax matters, interpretations of tax treaties, and structuring international operations are areas where the insights and expertise of a tax professional are invaluable. This section would highlight the importance of seeking professional advice in certain situations, ensuring that sole traders are making informed decisions based on accurate and up-to-date information.

Adapting To Changing International Tax Regulations

International tax laws are frequently updated and revised as global economic landscapes evolve. For Australian sole traders, staying abreast of these changes is crucial. This section of the article will focus on the importance of keeping up-to-date with international tax regulations and how changes can impact your business.

Also Read: How To Pay Yourself As A Sole Trader Australia?

It would offer insights into resources and strategies for staying informed, such as subscribing to international tax law newsletters, attending relevant webinars, and engaging with professional networks. Understanding that tax laws are not static but dynamic is key to ensuring ongoing compliance and making informed business decisions.

Maximising Tax Benefits Through Strategic Planning

Finally, understanding and navigating international tax laws is not just about compliance; it’s also about identifying opportunities to maximise tax benefits. Strategic tax planning can significantly impact the financial health of a sole trader’s business.

This section will delve into strategies for tax efficiency, including utilising tax credits and deductions available in different countries, understanding how to take advantage of tax treaties, and the role of strategic financial planning in reducing overall tax liabilities. It would also highlight how tools like the Sole app can aid in identifying such opportunities and streamline the tax planning process.

Conclusion: Embracing The Challenge With Confidence

In conclusion, while navigating international tax laws may seem daunting for Australian sole traders, it is a manageable and potentially rewarding endeavour. With the right knowledge, tools like the Sole app, and access to professional advice, traders can confidently expand their business internationally. Understanding and complying with international tax laws not only ensures legal compliance but can also lead to significant tax efficiencies and business growth opportunities.