As the end of the financial year passes, here at Sole we turn our attention to tax time. As a Sole Trader, you may be eligible for a suite of relevant tax deductions. Tax deductions have the power of putting your hard-earned cash back into your pocket and can help you reinvestment into your business.

What is a sole trader?

According to the Federal Government, a sole trader “is legally responsible for all aspects of the business including any debts and losses and day-to-day business decisions”.

As a sole trader, you are still paying the same amount of tax as you did in your full-time gig, it’s just that now it’s not taken out of your weekly pay check – you are responsible for managing it. To figure out the exact amount, you can use these income tax tools and information on the ATO website.

What is a tax deduction?

A tax deduction is a valid expense incurred in the course of producing taxable (assessable) income. The purpose of the tax deduction is to reduce your taxable income so you are only paying tax on income that exceeds the cost of running your business. For a sole trader this entails claiming business expenses such as car expenses, equipment costs, materials and certain other eligible operating expenses.

How does it differ from a tax offset?

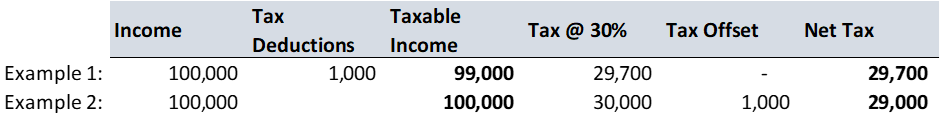

A tax offset for an individual directly reduces the amount of tax you pay whereas a tax deduction will reduce the taxable income which then decreases your tax bill.

For example, the table below shows the impact of a $1,000 tax deduction vs a $1,000 tax offset at a average tax rate of 30%.

It is important to remember that when you see big business advertising tax-time sales, if it is an eligible tax deduction, it will reduce your taxable income but won’t provide a $1:$1 tax deduction they want you to believe.

What kind of tax deductions can I make?

The general rule* for sole traders to know is that you can claim expenses that relate directly to producing assessable (taxable) income. These tax deductions are crucial to ensuring you are saving a bucket load of tax.

Below we have detailed some of the major examples of expenses relevant to Sole Traders:

Key Deduction 1: Car Expenses

If you’re a sole trader going from client site to client site, you may be eligible to claim car expenses as a tax deduction. In order to be eligible you must have a car that is less than a tonne and less than 9 seats.

If you meet the criteria, as a sole trader you can claim loan interest (or loan/lease costs), petrol, repairs and servicing costs, registration and insurance and depreciation costs. To claim these expenses you must choose your method of choice being the cents per kilometre or logbook method.

Key Deduction 2: Equipment and/or Materials

Whether you’re a sole trader working as a hairdresser, a plumber or an IT provider, you may be eligible to claim the “tools and equipment” of your job. Key rules to claim this deduction include:

- You must only claim the % that relates to your work (i.e. you can’t claim for personal use)

- Expenses under $300 you can immediately claim 100%

- Expenses over $300 you must work out the depreciation rate and only claim the annual depreciation amount.

Key Deduction 3: Operating Expenses

Sole traders encounter numerous other expenses not mentioned above including marketing costs, advertising costs, legal and consulting fees, insurance premiums, interest on loans, IT expenses and sub-contractor costs.

As long as the expenses are proven to be for the purpose of increasing your assessable income, you may be able to claim a deduction on these items.

How can I claim these tax deductions?

On your tax return, you will be presented with declaring your income and expenses.

To ensure that you can claim deductions on your tax return:

- MUST keep evidence such as bank statements, receipts, tax invoices and if relevant, contracts.

- Your expense must have been paid during the financial year

- Your expense must be DIRECTLY related to your income earning activity

- If the expense is used for both work and personal, you may only claim the % portion of the expense that relates to the income earning activity.

Each Sole trader is different and will have different expenses which may or may not be tax deductible. At Sole, we encourage you to talk to your local accountant to determine the extent of the tax deductions available to you. Maximising your allowable tax deductions will put cash into your pocket and will allow you to continue to grow your small business.

Thinking of starting up your own business? Check out our Sole Trader start up guide for tips and tricks: The Sole Trader Start-up Guide | Sole Accounting App | 2023 (soleapp.com.au)

You can download the pdf version of this article here.

*The information on Sole is intended to be general in nature and is not personal financial product advice. It does not take into account your objectives, financial situation or needs.