Effective expense tracking is essential in today’s fast-paced financial landscape, especially in Australia, where businesses must keep abreast of every dollar spent. Whether you’re a sole trader, freelancer, or small business owner, the right expense tracker can make a difference. This article explores the top five expense-tracking apps, each offering unique features to cater to diverse business needs. Leading the pack is the Australian-made SoleApp, a tool designed with the local market in mind.

1. SoleApp: A Tailored Tool For Australian Businesses

SoleApp, specifically designed for Australian sole traders, freelancers, and small businesses, emerged in 2018 as a response to the unique financial management needs within the Australian business context. Its design and functionality are deeply rooted in the nuances of the Australian market, making it a highly relevant and efficient tool for local businesses.

Ease Of Use And Local Relevance

SoleApp’s user-friendly interface is a significant draw for users, especially those constantly on the move. The app simplifies receipt capture and storage, with cloud-based functionality ensuring that all expenses are recorded and easily accessible. This feature is particularly valuable in a landscape where mobile business operations are increasingly common. Furthermore, SoleApp is attuned to the specifics of the Australian tax system, offering features that help businesses stay compliant with local regulations. This alignment with local tax laws greatly reduces the complexity and stress associated with tax preparation and submission.

Also Read: How To Become A Personal Trainer In Australia? A Detailed Guide

Innovative Expense Management

Beyond its user-friendly design, SoleApp’s ability to connect multiple bank accounts for comprehensive tracking of income and expenses is a standout feature. This integration offers Australian business owners a holistic view of their financial health, enabling them to make informed decisions. The app also includes functionalities tailored to the needs of small businesses, such as generating professional invoices, tracking overdue payments, and providing insights into cash flow. These features are not just about recording expenses; they are about empowering businesses with the tools to manage their finances proactively.

2. QuickBooks: A Global Giant In Expense Tracking

QuickBooks has established itself as a global leader in the expense tracking domain, renowned for its extensive and versatile features. It serves a diverse client base, ranging from individual freelancers to large corporations, offering a comprehensive suite of financial management tools.

Comprehensive Financial Management

QuickBooks offers an all-in-one solution for financial management, making it a robust choice for businesses seeking a comprehensive approach. Its capabilities extend beyond mere expense tracking; it encompasses invoice management, payroll processing, and the generation of detailed financial reports.

Also Read: How To Find A Personal Trainer For Seniors Today

These features provide businesses with a 360-degree view of their financial status, facilitating better strategic planning and decision-making. Moreover, QuickBooks’ user-friendly dashboard presents critical financial data in an easily digestible format, allowing business owners to quickly grasp their financial standing.

Scalability And Integration

A key strength of QuickBooks is its scalability. The software is designed to grow with a business, ensuring that its financial management capabilities remain aligned with the business’s evolving needs. This scalability is crucial for small businesses that aspire to expand over time. Additionally, QuickBooks’ ability to integrate with a wide array of other business applications greatly enhances its utility.

This integration capability means that QuickBooks can operate within a larger ecosystem of business tools, streamlining various business processes and reducing the need for multiple standalone applications. This interconnectedness is particularly beneficial in today’s digital age, where efficiency and synergy across different business functions are paramount.

3. Xero: Simplifying Finances For Businesses

Xero, a New Zealand-based software, has gained international acclaim for its user-centric approach to financial management. Its appeal lies in transforming complex financial tasks into straightforward processes.

Intuitive Interface And Accessibility

Xero’s interface is crafted for clarity and ease of use, making it an ideal choice for business owners without a finance background. The dashboard presents key financial information at a glance, allowing users to understand their financial position quickly.

Versatile Integration And Collaboration

The software excels in its integration capabilities, seamlessly connecting with over 800 third-party apps. This feature enables businesses to create a customised ecosystem of business tools. Furthermore, Xero facilitates collaboration between business owners and accountants or financial advisors, ensuring everyone is aligned with the financial health of the business.

Also Read: How To Sell Personal Training: Expert Tips For Success

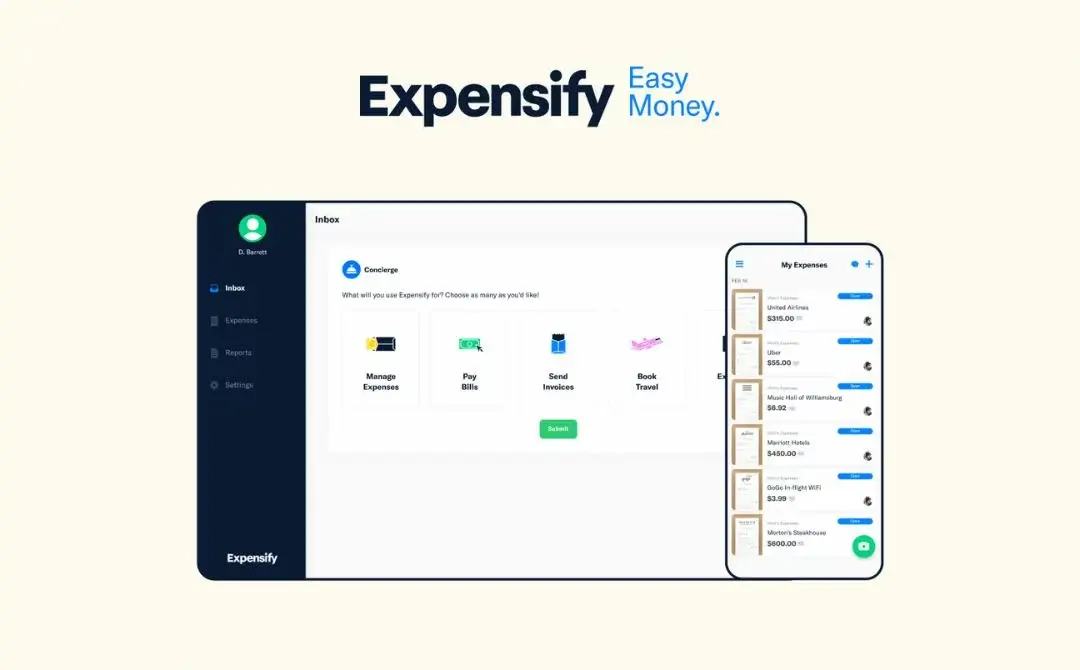

4. Expensify: The Traveler’s Companion

Expensify specifically addresses the needs of businesses and individuals who incur frequent travel expenses. Its mobile-first approach and automated features set it apart in the realm of expense tracking.

SmartScan and Advanced Automation

Expensify’s SmartScan technology allows users to take a photo of receipts, which the app then automatically processes and categorises. This feature minimises the time spent on manual data entry and reduces errors.

Corporate Card Reconciliation

For businesses with corporate cards, Expensify simplifies the reconciliation process. The app links directly to the cards, pulling in expenses and matching them to receipts, streamlining the approval and reporting process.

Travel Integration

Expensify integrates with travel booking platforms, allowing for a seamless connection between trip planning and expense tracking. This integration is particularly useful for companies managing business travel, providing a consolidated view of travel expenses.

5. Zoho Expense: Streamlining Expense Management

Zoho Expense is part of the Zoho suite, known for its comprehensive business solutions. The app is designed for businesses seeking a highly customisable and integrative approach to expense management.

Automation And Intelligent Workflows

Zoho Expense automates the expense recording process, using artificial intelligence to categorise and report expenses. Its intelligent workflows can be customised to match the unique approval processes of different businesses, enhancing efficiency and control.

Integration With Zoho Suite And Beyond

As a part of the Zoho ecosystem, Zoho Expense integrates seamlessly with other Zoho applications, such as Zoho Books and Zoho CRM. This integration facilitates a unified approach to business management. Additionally, it offers integration with popular external applications, providing flexibility in how businesses manage their finances.

Also Read: Is It Illegal To Be A Personal Trainer Without Certification?

Global Capabilities And Multi-Currency Support

Recognising the global nature of business, Zoho Expense supports multiple currencies and is equipped to handle various tax regimes. This makes it a suitable option for businesses operating internationally or dealing with foreign transactions.

Conclusion

In sum, while each of these expense trackers offers unique benefits, SoleApp stands out for its local focus and intuitive design, making it an ideal choice for Australian businesses. QuickBooks and Xero offer comprehensive and user-friendly solutions for a broader audience, while Expensify and Zoho Expense provide specialised features for travel expense management and automation, respectively. Choosing the right expense tracker can significantly impact a business’s financial management efficiency, offering not just ease of use but also valuable insights for better financial planning.