In today’s fast-paced business environment, the right accounting software is more than a convenience—it’s necessary. Especially in Australia, where unique tax and financial regulations apply, choosing software that caters to these specific needs is crucial. This article explores the top 8 accounting software options tailored for the Australian market, each offering unique features and benefits.

1. SoleApp: Specifically Designed For Australia

SoleApp is a standout choice for Australian sole traders, freelancers, and small businesses. Launched in 2021, it’s a testament to innovation in addressing the specific accounting challenges faced in Australia.

Australian-Centric Approach: SoleApp focuses exclusively on Australian accounting standards and tax laws, ensuring users remain compliant and up-to-date with local regulations.

Intuitive User Experience: With an easy-to-navigate interface, SoleApp makes accounting tasks straightforward, even for those without a financial background.

2. Reckon One: Versatile And Affordable

Reckon One is an Australian-made software that offers a high degree of versatility and affordability, making it an ideal choice for small to medium-sized businesses.

Modular Design: Reckon One operates on a unique modular system, allowing businesses to add or remove features based on their specific needs, ensuring they only pay for what they use.

Also Read: How To Pay Yourself As A Sole Trader Australia?

Comprehensive Functionality: It includes features such as invoicing, payroll, and project tracking, providing a comprehensive toolset for business management.

3. Saasu: Streamlined And Efficient

Saasu is another great choice, especially known for its efficiency and streamlined operations, which can be a boon for small and medium enterprises.

Cloud-Based System: As a cloud-based software, Saasu offers the convenience of accessing financial information from anywhere, a significant advantage for businesses with remote operations.

Automation Features: It automates several accounting tasks like bank feeds and recurring invoices, significantly reducing the time spent on manual data entry.

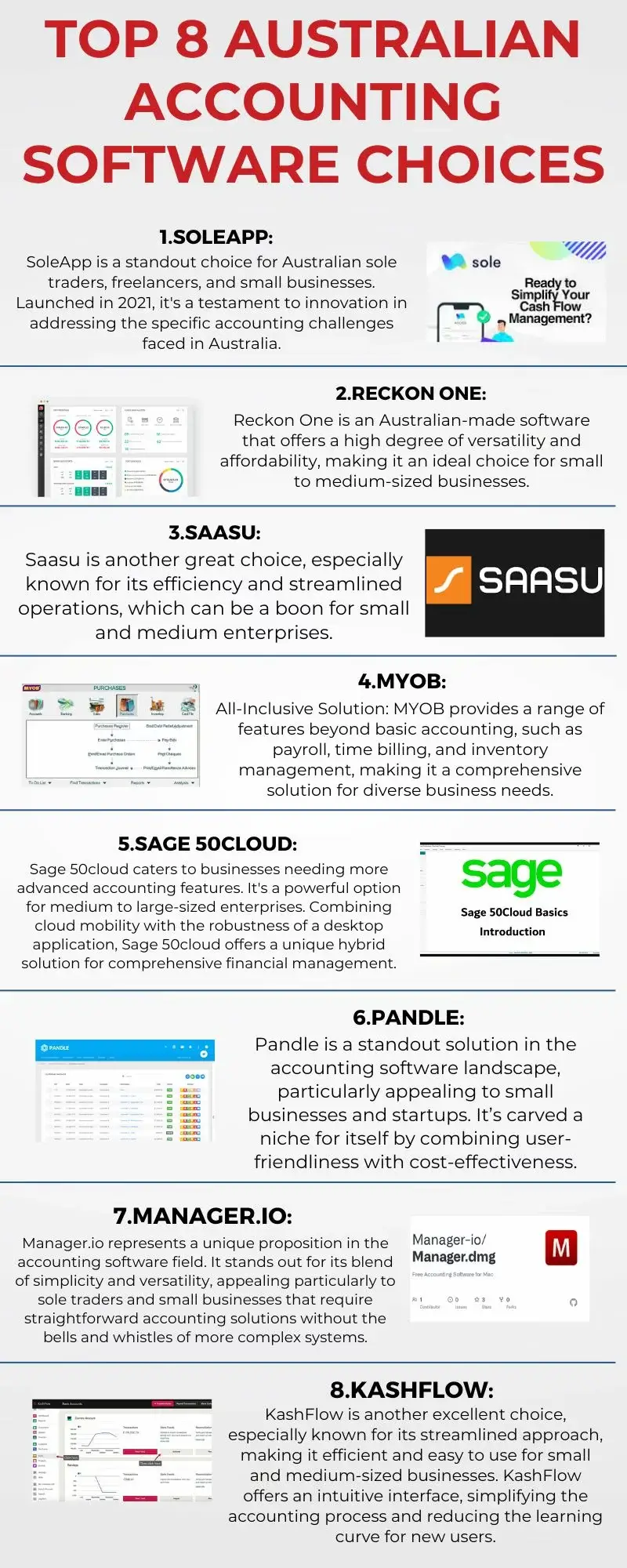

4. MYOB: A Trusted Name In Australian Accounting

MYOB has been a trusted name in Australian accounting for years, offering solutions catering to small and large businesses.

All-Inclusive Solution: MYOB provides a range of features beyond basic accounting, such as payroll, time billing, and inventory management, making it a comprehensive solution for diverse business needs.

Local Focus: Tailored for the Australian market, MYOB ensures compliance with local tax and financial regulations, similar to SoleApp.

5. Sage 50cloud: Advanced Accounting For Growing Businesses

Sage 50cloud caters to businesses needing more advanced accounting features. It’s a powerful option for medium to large-sized enterprises.

Hybrid Solution: Combining cloud mobility with the robustness of a desktop application, Sage 50cloud offers a unique hybrid solution for comprehensive financial management.

Extensive Features: It provides advanced capabilities like detailed financial reporting, multi-currency support, and inventory management.

Also Read: How To Pay Tax As A Sole Trader?

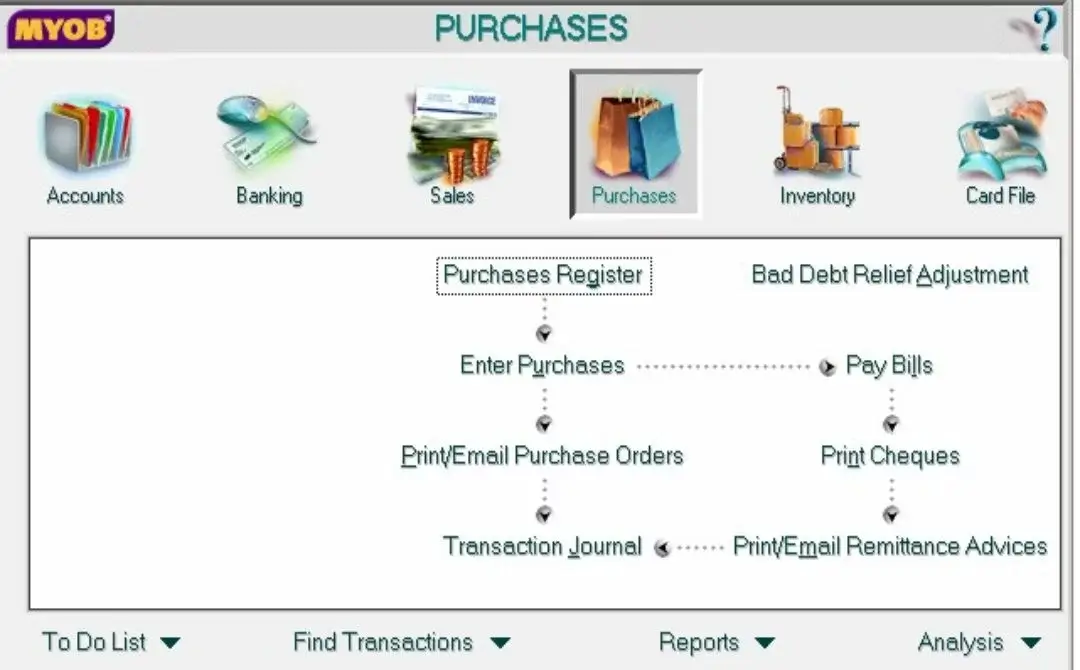

6. Pandle: User-Friendly And Cost-Effective

Pandle is a standout solution in the accounting software landscape, particularly appealing to small businesses and startups. It’s carved a niche for itself by combining user-friendliness with cost-effectiveness, making it an attractive option for those just entering the business world or operating on a lean budget.

Ease of Use: Pandle’s primary draw is its intuitive interface. The software is designed to be accessible even to those with minimal accounting experience. This user-friendly approach means that small business owners can take charge of their finances without feeling overwhelmed by complex accounting jargon or processes. Pandle simplifies tasks like bank reconciliation, financial reporting, and VAT filing, making them manageable and less time-consuming.

Affordable Pricing: Understanding the financial constraints that small businesses often face, Pandle offers a free version alongside a premium option that’s reasonably priced. This pricing structure ensures that essential accounting tools are accessible to all businesses, regardless of their budget. The free version covers basic accounting needs, while the premium option includes advanced features like multi-currency support, project tracking, and receipt uploading, providing a scalable solution as businesses grow.

7. Manager.io: Versatility In Simplicity

Manager.io represents a unique proposition in the accounting software field. It stands out for its blend of simplicity and versatility, appealing particularly to sole traders and small businesses that require straightforward accounting solutions without the bells and whistles of more complex systems.

Free and Easy-to-Use: The most striking feature of Manager.io is that it’s entirely free. This aspect makes it an ideal choice for small businesses and sole traders who are just starting and need basic accounting functions without a financial burden. The software’s design focuses on ease of use, with a clean, intuitive interface that makes navigation and task completion straightforward. This ease of use does not come at the expense of functionality; Manager.io covers all the essential accounting tasks a small business would need.

Comprehensive Toolset: Despite its straightforward design, Manager.io packs a surprisingly comprehensive set of features. Users can benefit from functionalities like invoicing, expense tracking, financial reporting, and even more advanced features like inventory management and payroll processing. This comprehensive toolset ensures that even as a business grows, Manager.io can continue to meet its evolving accounting needs. The software’s ability to handle multiple aspects of business finance makes it not just a tool for bookkeeping but a comprehensive financial management solution.

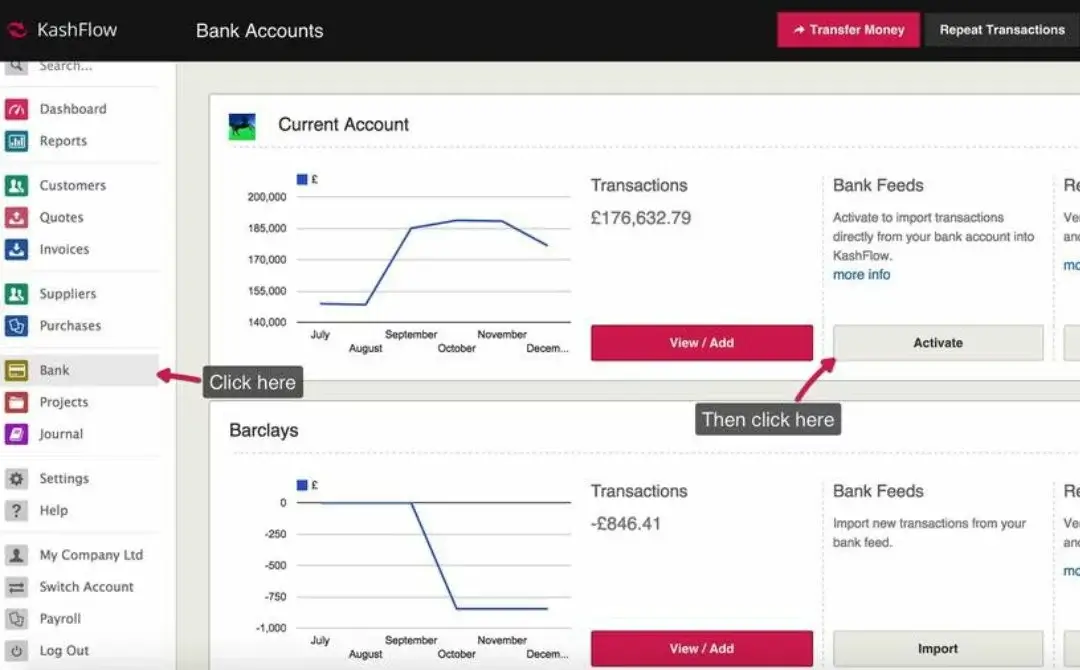

8. KashFlow: Streamlined For Efficiency

Finally, KashFlow is another excellent choice, especially known for its streamlined approach, making it efficient and easy to use for small and medium-sized businesses.

Intuitive Interface: KashFlow offers an intuitive interface, simplifying the accounting process and reducing the learning curve for new users.

Also Read: GST For Sole Traders: Navigate Compliance & Benefits

Comprehensive Features: Like many of its counterparts, it provides a complete range of features, including invoicing, payroll, and financial reporting, tailored to suit the needs of growing businesses.

Conclusion

In the quest for the perfect accounting software, Australian businesses have a wealth of options, each with its unique strengths and specialisations. From the locally focused SoleApp to the versatile Reckon One and the comprehensive offerings of MYOB and Sage 50cloud, the choice depends on your business’s specific needs and size. These top 8 options provide Australian businesses with the tools to manage their finances efficiently, ensuring compliance with local standards and enabling them to thrive in a competitive environment. The right accounting software streamlines financial management and empowers businesses to make informed decisions, driving growth and success.